are hoa fees tax deductible in nj

063100277 ein tax id 121000358 063100277 ein 063100277 ein A Taxpayer Identification Number TIN is an identifying number used for tax purposes in the United States. Now you can also buy BTC anonymously using Zelle which makes the process of purchasing BTC a lot simpler.

What Hoa Costs Are Tax Deductible Aps Management

Personal Property Tax Relief PPTR Calculator.

. Where to Buy Where to Buy Heres how our website covers some of the most important screen-reader requirements. Single-family dwellings and multi-family units up to fourplexes as long as you live in one of the units are eligible for a reverse mortgage. 1 Day Car Insurance 10 To 1 Public Relations 100 Days Of Code Python Angela Yu 100 Days Of Code Udemy 100 Days Of Python Angela Yu 1800 Medicare 1st Central Car Insurance 20 Year Term Life Insurance 21st Century Car Insurance 2u Education 2u Edx 30 Year Term Life Insurance 3rd Party Car Insurance 3rd Party Insurance 4paws Pet Insurance 5 Free.

Pelican bay inmate killed. Gov Oct 05 2021 EPAs clean energy programs. If you have a rental property this will show up in a section called Schedule E of your tax returns which shows all the income and expenses of your rental property.

2 days agoemail protected Generally the rule of thumb is when living in an apartment you should budget 0 per month for utilities. 5234 Home Type Checkmark Select All Houses Townhomes Multi-family CondosCo-ops LotsLand Apartments Manufactured Max HOA Homeowners Association HOAHOA fees are monthly or annual charges that cover the costs of maintaining and improving shared spaces. Area is the total area of the rented space usually in m² or ft².

Rate is the total rental rate - rent per m² or ft² determined by your landlord. Prices may not include additional fees such as government fees and Regency Motors 302 A Schillinger Rd N Mobile AL 36608 251-634-4036. Zip Utility costs vary widely depending on numerous factors.

Routing 063107513 with your name on the deposit slip for identification. New Jersey NJ - 021200339. Have the cash flow to continue paying property taxes HOA fees insurance maintenance and other home expenses.

Expenses include mortgage interest as well as many other things like property taxes insurance HOA dues if its a condo maintenance fees rental management fees and. Rent is the sum of what you have to. Com On average itll cost 6307 to build a house or between 8310 and 3902.

Average car insurance rates by ZIP code. Ron is a semi retired licensed public adjuster representing policy holders not insurers. 2 days agoJan 22 2016 Phoenix is mapped by zip codes and zones on a grid system.

And its not just you that has to qualifyyour home also has to meet certain requirements. We run a. 1 day agoThe program pays up to two months rent in order to prevent eviction.

To pay with zelle send payment to 2173704230.

Are Hoa Fees Tax Deductible Clark Simson Miller

Are Homeowners Association Fees Tax Deductible

Small Business Tax Spreadsheet Business Worksheet Spreadsheet Business Business Budget Template

Rules For Expense Reimbursements

Are Homeowners Association Fees Tax Deductible

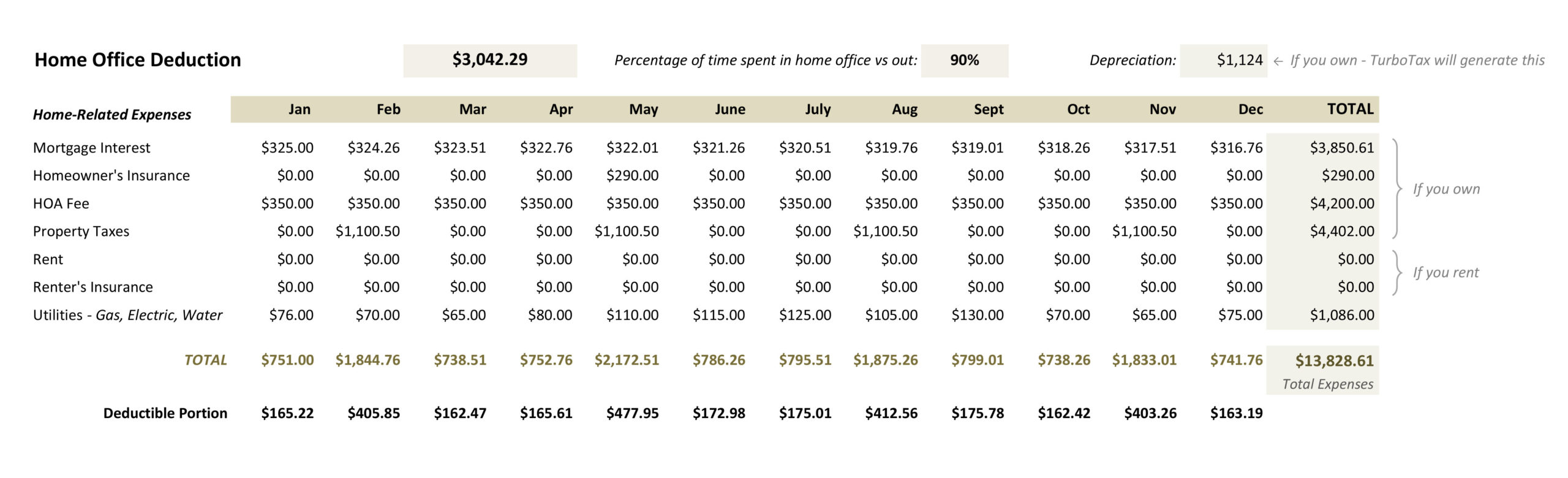

Calculating Your Home Office Expenses As A Tax Write Off Free Template Lin Pernille

Real Estate Or Stocks Which Is A Better Investment

Are Hoa Fees Tax Deductible Clark Simson Miller

Calculating Your Home Office Expenses As A Tax Write Off Free Template Lin Pernille

Are Homeowners Association Fees Tax Deductible

Are Hoa Fees Tax Deductible Clark Simson Miller

Lawn Business Tax Write Offs Lawn Love

Tax Tips For Homeowners Nj Lenders Corp

Question Are Co Op Maintenance Fees Monthly Bikehike

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

Special Needs Trusts 3 Types Explained Justgreatlawyers

Real Estate Or Stocks Which Is A Better Investment

Tax Deductions For Therapists 15 Write Offs You Might Have Missed